|

Oct 17, 2000

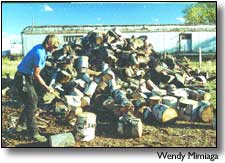

By Jim Mimiaga Increasing energy prices are hitting the Southwest, with the next rise in prices expected soon for natural-gas customers. Citing higher demand and the inevitable consequence ó higher commodity prices ó Greeley Gas will again push up the amount it charges for natural gas in Cortez and Durango, this time by 13 percent, pending Public Utility Commission approval. That approval is expected within days, said Greeley spokesperson Karen Wilkes, and will result in an applied cost of 70 cents per 100 cubic feet billed beginning Nov. 1, up from 61 cents. Translated to a bill for an average residential family during an average cold winter (111 ccf per month), the increase means $10 more per month for using the clean-burning, efficient fuel, estimated Wilkes. She said that the price is directly correlated with rising market prices. "The commodity increase we pay is a pass-through cost; we do not make a profit on the increase," said Wilkes. "When it goes down, we will pass that on to the customer also." That is not likely though, as Greeley Gas officials expect yet another increase beginning after the first of the year. Rather than passing on a sudden jump in the commodity price that began earlier this year in one lump, the company is "stepping up" increases over time. February and July also saw rate increases for natural gas locally. Nationwide, natural-gas usage is on the increase over other energy sources because it is relatively cheap, safer for the environment, and an efficient way to run heating and production equipment. Because of such redeeming qualities, the latest national trend is for electricity plants to power up generators by burning natural gas rather than coal, a notorious polluter. Those factors, combined with a full-throttled U.S. economy relying heavily on electricity for growth and expansion, means bigger-than-ever demand, with producers scrambling to catch up. And the race to keep up with demand is intensifying, especially as rapid growth fueled largely by the power-hungry computer industry does not appear to be subsiding. "Usually during the summer, demand for natural gas goes down, but that did not happen this year," Wilkes said. "It used to be very cold-driven, but now it is being driven by the need for electricity, which is linked back to natural gas. Plus it is environmentally very popular." Worldwide, energy prices for commodities including crude oil, electricity and heating oil have also been steadily climbing. Although the need for oil is high now, oil production outpaced demand in the last five years; the fuel market had been stymied somewhat as demand dropped following the Asian market crash. Last year, that scenario led to unrefined, wholesale oil selling for $11 per barrel compared to todayís price of $37 per barrel. But the over-production that led to such an extreme drop in prices was a market anomaly, analysts say. Thatís because despite Asiaís troubles, the United States and other countries have continued to strengthen their economies as never before, straining what is now considered to be a limited energy supply, thereby increasing prices at the pump. Lagging prices in the past also led some smaller energy-producers to pull back, but now idle drilling equipment and leases are being put back to work in order to take advantage of a better return on investment. Usually the predicted increases in the supply take one to two years before the consumer benefits from lower prices. Natural-gas consumers are helpless when it comes to the whims of the market, which will improve once production increases to match the need. "Itís up (production) quite a lot, but we wonít see the benefits for a while yet," Wilkes said. "Conservation of energy is very important in times like these." Meanwhile on the East Coast, heating-oil prices are going through the roof, leading many to switch to wood-burning stoves as an alternative heat source. They are selling rapidly in frigid places such as Maine and New Hampshire, but the trend has yet to hit the Southwest. "Sales are normal now," said Juan Tafoya, manager of Starfire, Fireplace and Stove in Farmington. "But the factories are all out of stoves, so if it did happen here I would have trouble getting in new stock." |

||

|

Copyright © 2001 the Cortez Journal.

All rights reserved. |